A variance report is a financial document that compares actual performance against budgeted or planned performance in specific categories such as revenues, expenses, and overall profit. For a small business owner, it serves as a diagnostic tool to identify operational inefficiencies, assess financial health, and make informed decisions. By analyzing the variances between actual and projected figures, you as the business owner can pinpoint areas that require your attention, allocate resources more effectively, and adapt your strategies for better financial performance.

In this guide to understanding financial reports:

What is a variance report?

Put simply a variance report is an essential financial document that shows the differences between expected financial outcomes and actual results. It will highlight areas of strength and should expose unexpected pitfalls.

Every business sets financial targets or at least should. A variance report discloses how close or far a business is from hitting those targets. This is crucial for businesses, as it highlights what areas need attention and where the business is excelling. When businesses are aware of this they are able to act with confidence and respond to the trends that are shown.

How do variance reports work?

Here’s a simple breakdown of how variance reporting works:

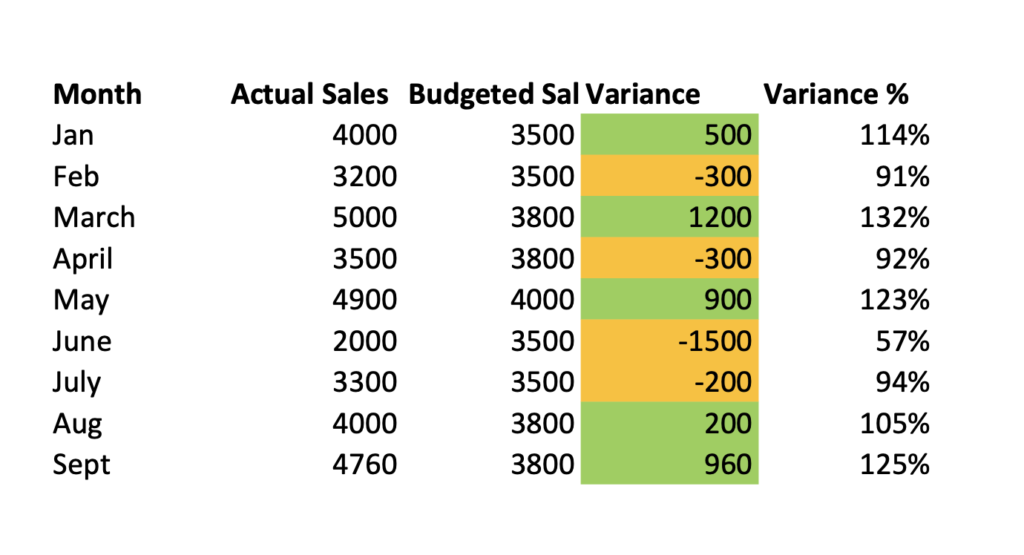

- Actual results: These are real, recorded figures from your business during a specified period.

- Forecasted figures: These are the predictions or estimates that you projected the business would make.

- Variance: This is the difference between the two. To calculate it you take the actual results from the forecasted figures. This will show you the variance.

If a business outperforms its forecasts, it is called a favorable variance. Alternatively, if it falls short, it has an unfavorable variance. Understanding these variances can help you adjust your business strategies.

Here is a budget variance report example:

How do you create a variance report?

Creating a variance report can be a straightforward process and the results can be incredibly insightful. To help you create one for your business you will need to:

- Gather data

You begin by collecting all the necessary financial data. This includes the actual figures representing your business’s performance and the forecasted or budgeted figures that you initially projected. You can use your accounting software to pull actual P&L statements from specific periods. - Identify variances

With the data in hand, you can calculate the variance for each item by subtracting the forecasted figures from the actual results. This exercise will reveal the discrepancies between what was expected and what actually occurred. - Analyze

Once you’ve calculated the variances, categorize them as either favorable or unfavorable. A favorable variance indicates you’ve outperformed expectations – perhaps you’ve earned more revenue or incurred fewer expenses than predicted. On the other hand, an unfavorable variance suggests the opposite, where your actual figures might fall short of forecasts. This step is crucial as it sets the stage for deeper analysis and strategic adjustments. - Comment

For each significant variance identified, it’s essential to take a look at the results and think of potential reasons why it was favorable or unfavorable. For instance, an unexpected spike in sales might be attributed to a successful marketing campaign, while an unforeseen rise in expenses could be due to increased raw material costs. By providing context to the numbers, you’re better equipped to make informed decisions moving forward.

A key thing to remember is that a variance report isn’t just about presenting data. A key element is understanding and interpreting that data to guide your business decisions. As you become more accustomed to variance reporting, you’ll find it becomes a useful report that you refer to whenever making a decision in your business.

Who needs a variance report?

Often larger enterprises have entire departments who are dedicated to analyzing the finances. Small to medium-sized businesses however, lack the back office accounting support to do this on a regular basis for them. You’ll need to create your own reports or outsource this service to a specialist in variance reporting, usually an accounting firm that provides CFO services.

As your business grows, it is important to understand your finances and whether or not you’re on track. With the right information you’ll be empowered to take proactive steps, based on real data, to direct your business in the right directions towards growth.

Why do you need a variance report?

There are 3 main reasons as to why you need one:

- Informed decisions

By comparing forecasted figures with actual outcomes, these reports shed light on areas of overperformance or underperformance. This information will act as a guide to your strategic planning and operational adjustments. Whether it’s a regular variance report or a specialized budget variance report, the insights gathered can help tailor strategies that align better with real-world scenarios. - Risk management

Proactive management can substantially mitigate risks to your business. Through variance reporting, unfavorable discrepancies, whether that be in revenues, costs, or any unforeseen circumstances that can impact your business, start to become highlighted so you can identify and mitigate anything within your control. Identifying these risks early on allows businesses to devise contingency plans or corrective actions, ensuring they’re not caught off-guard. For instance, a budget variance report example might highlight escalated operational costs, signaling a need for a review of suppliers or processes. - Resource allocation

The variance reports, highlight performance whether favorable or unfavorable, it allows your business to allocate resources more effectively. For instance, if a particular product line consistently outperforms forecasted sales, it might warrant increased investment or marketing support. On the other hand, underperforming areas might require re-evaluation or redirection of resources. In essence, variance reporting acts as a guidepost, ensuring resources – whether financial, human, or operational – are channeled in the most impactful manner.

What to include in a variance report?

A well-structured variance report ensures these 3 things – clarity, comprehensibility, and actionable insights.

Here’s a breakdown of what a comprehensive variance report – whether it’s a standard report or a specialized budget variance report – should include:

- Summary

Begin with an overview that captures the most significant findings. This will serve as a quick reference for those who might not analyze the entire report. This section answers the primary question: “What is the variance report highlighting in terms of deviations and performance?” - Detailed analysis

Thorough examination of each variance, whether related to sales, overhead costs, operational expenses, or other metrics, should be included. By looking at the analysis it should be clear how the businesses finances are working. An example here could be a budget variance report that meticulously breaks down each cost category, showcasing deviations and patterns for your business. - Recommendations

This will give suggested actions to address the identified variances. Understanding the data is just the first step, it’s the strategic recommendations that drive actionable change. For instance, you might recommend a shift in marketing strategies or a review of procurement processes based on the results.

As you can see your variance report must be up to date and based on real numbers, otherwise it will not be useful.

Variance reporting is an extremely useful financial tool in any business. At Bluebird Partners, we can provide you with monthly variance reports as part of our advisory and CFO services. Contact us for more information.